New Working Paper: “Growth and Predictability of Urban Housing Rents”

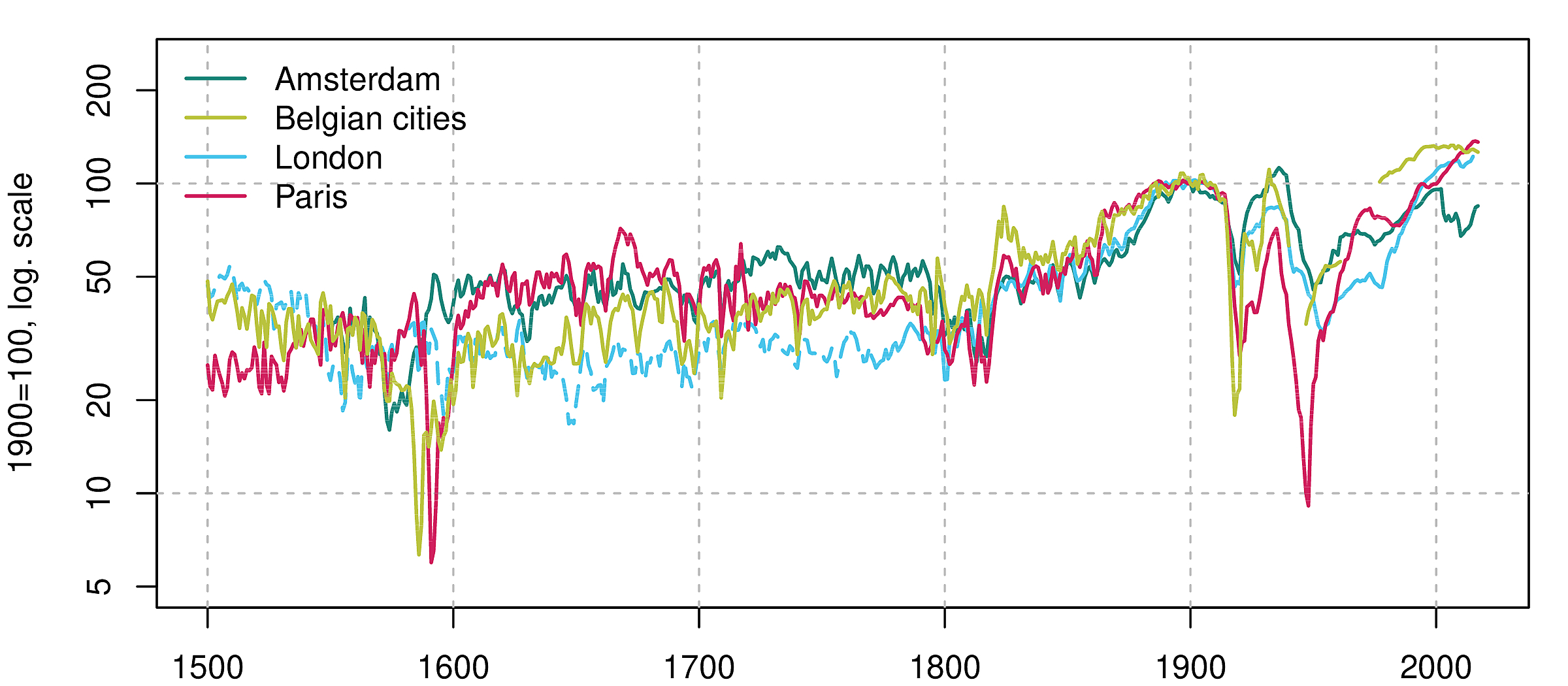

This paper studies urban rental prices for half a millennium (1500–2020) and seven cities: Amsterdam, Antwerp, Bruges, Brussels, Ghent, London, and Paris. Based on a dataset of 436,000 rental cash flow observations, we build continuous annual indices of housing rents, which we employ to study the long-term developments in rental cash flows, as well as their predictability. We find that real rent growth has been limited, but with large differences across cities: average annual growth rates range between 0.12 percent for the Belgian cities to 0.30 percent for Paris. At the market level, we show that sluggish supply adjustment implies that past population growth negatively predicts current rental growth. At the individual asset level, we find that past excess rental growth rates are predictive of future rent revisions, and that increasing steepness of the term structure of contract rents is predictive for future rent levels.

Half a millennium of real housing rents

Working paper: Link