An Affordability Revolution?

Link to paper: A Housing Affordability Revolution?

We study housing affordability in seven European cities from 1500-2024, using nearly half a million rent observations linked to wages, quality, and inequality. Constant-quality real rents rose slowly, while housing quality improved substantially. The 1910s-1970s saw a “housing affordability revolution,” with rapid wage growth relative to rents, declining inequality, and large-scale housing policies. Yet expenditure shares increased, particularly among low-income households. We use a Stone–Geary framework to reconcile these facts: rising minimum housing standards steepen Engel curves, raising budget shares at the bottom even when rent-to-wage affordability improves. Prices are an incomplete guide to affordability when housing standards evolve.

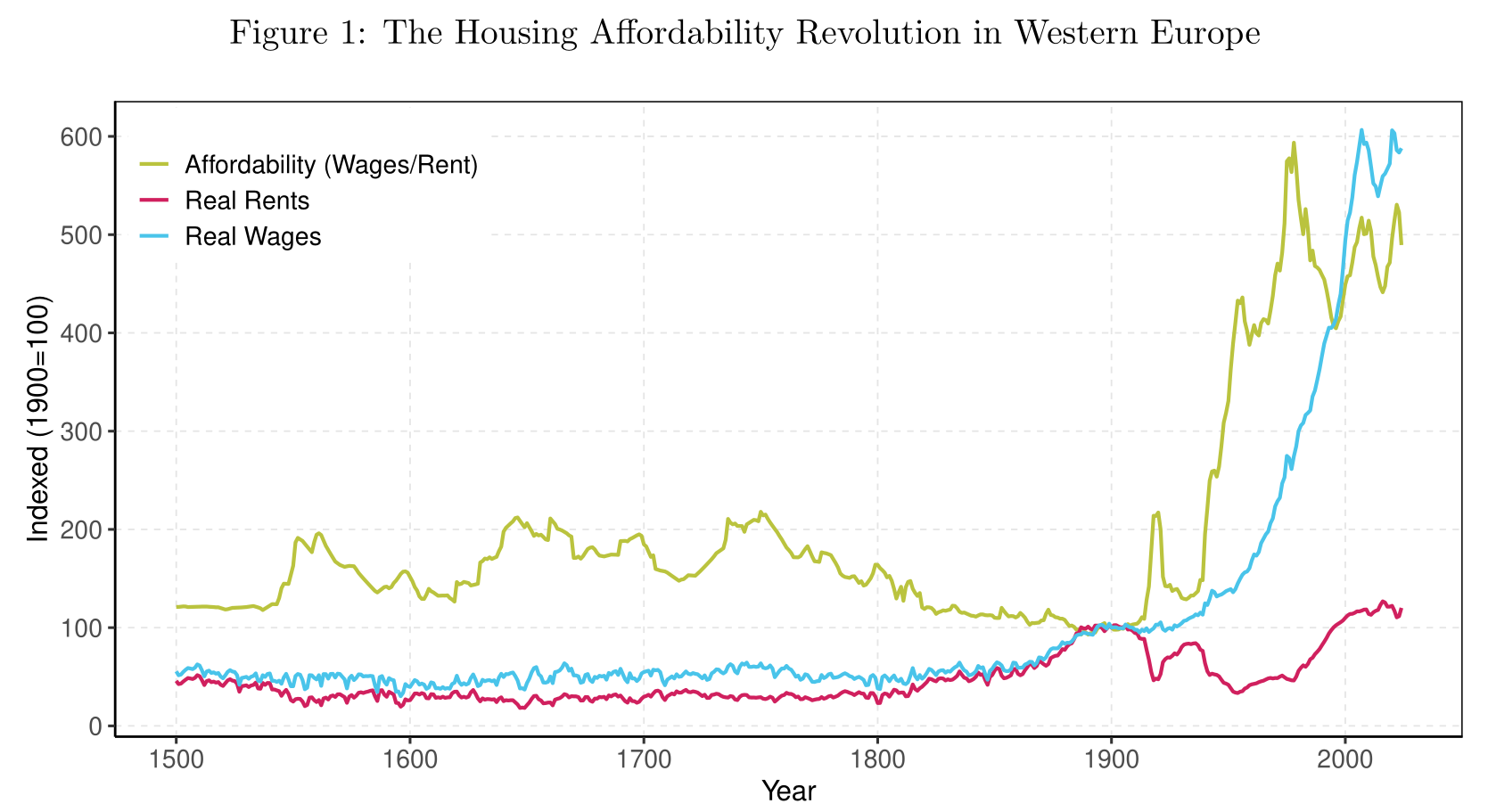

This figure plots the real rent index, the real wage index, and the implied “affordability” index (wages relative to rents) for a weighted average of Amsterdam, London, Paris, and the four Belgian cities in our sample, 1500–present.

Until the early twentieth century, real wages and rents moved broadly together, implying no sustained trend improvement in conventional rent-to-wage affordability. A marked divergence emerges only in the twentieth century: from the 1910s through the postwar decades, wages rose much faster than rents, generating large and persistent gains in rent-to-wage affordability. These gains largely plateaued in the late 20th century, as wage growth slowed and public investments in housing were rolled back, while housing consumption per capita continued to rise. A natural interpretation of this figure is that affordability improved dramatically in the last century. However, that reading clashes with the dominant contemporary narrative in cities around the world. Our paper shows how both can be the case.