New Publication: The Total Return To Real Estate

New research accepted for publication at the Review of Financial Studies (RFS):

Piet Eichholtz, Matthijs Korevaar, Ronan Talled and I estimate total returns to rental housing by studying over 170,000 hand-collected archival observations of prices and rents for individual houses in Paris (1809–1943) and Amsterdam (1900–1979). The annualized real total return, net of costs and taxes, is 4.0% for Paris and 4.8% for Amsterdam, and entirely comes from rental yields. Our returns correlate weakly with the implied returns in Jorda et al. (2019) and are substantially lower. We decompose total return risk at the individual asset level, and find that yield risk becomes an increasingly important component of property-level risk for longer investment horizons.

Full paper: Link

Highlights: Total returns in Paris and Amsterdam

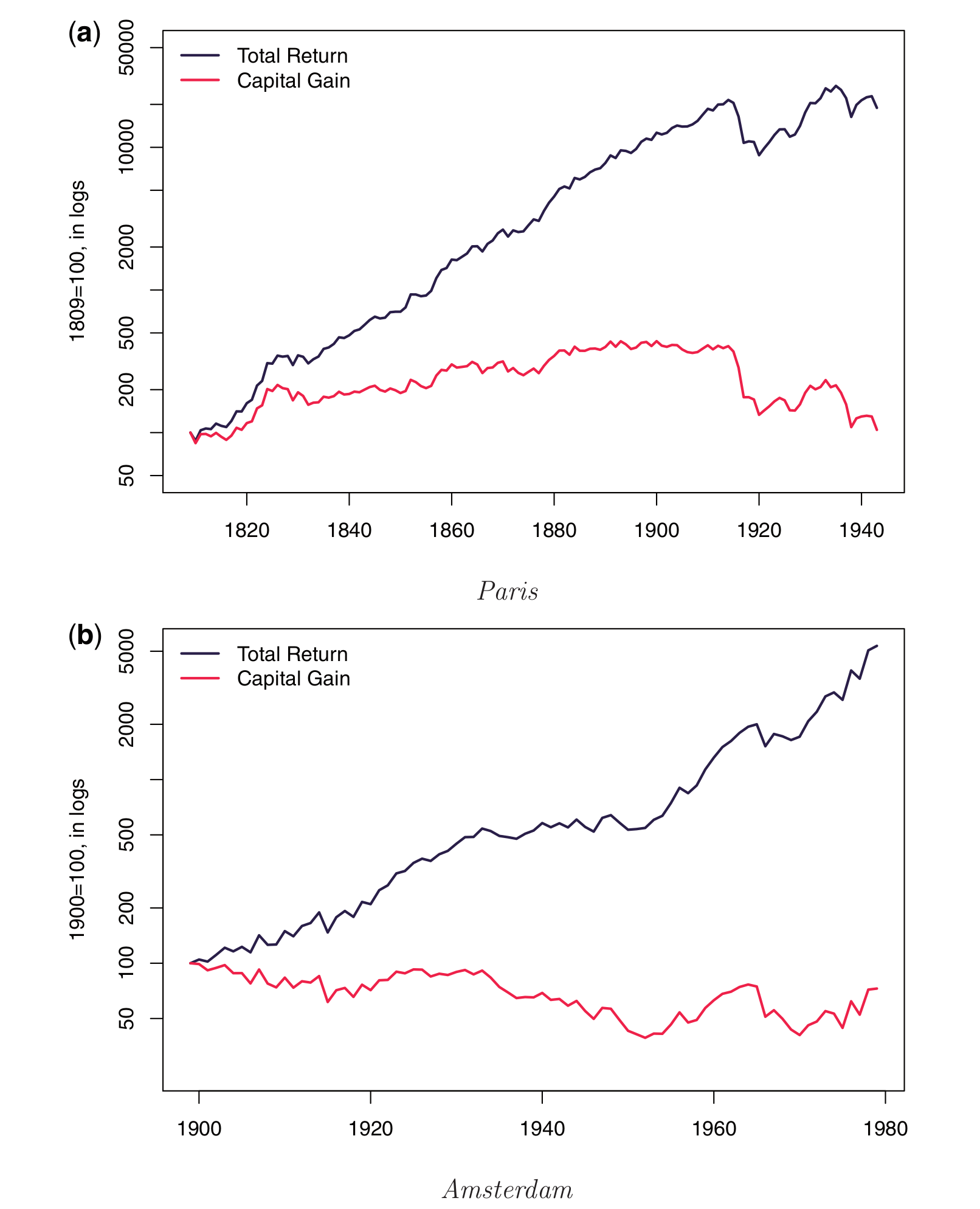

These graphs depict inflation-adjusted cumulative total returns and capital gains for Paris and Amsterdam. Real capital gains are dwarfed by total returns, but the price volatility is very visible, especially for Paris after 1914.

World War I scarred the real estate investment performance in Paris but did not affect Amsterdam much. In Amsterdam, real total returns steadily accumulated up to the 1930s, then went into a 20-year hiatus before picking up pace again in the 1950s.